How Students Can Help VC Firms (Project Ideas)

Note: the above image is from Unsplash, an aggregator of free, high-quality stock photos.

Oftentimes when students work for VC firms they'll be assigned sourcing work or market research projects. I explain those two activities briefly here and then suggest several other ways that students can be useful to VC firms. This includes projects on the platform and operations sides, and these types of projects are just as doable by student interns as sourcing and market research.

Every VC firm is different, so in a lot of cases, many of these activities will not be very applicable. For example, some firms like Andreessen Horowitz have a stronger focus on platform (hosting events, writing content, helping portfolio companies with recruiting, etc), while others like Benchmark prefer to operate on a more lean model with few non-partner resources. Both approaches are valid and produce successful VC firms with great returns.

If you're a student or early-career VC working with a smaller firm, consider suggesting some of these project ideas to your supervisors. That being said, the partners and long-time employees of the VC firm will often know best what they need help with, so it's also a good idea to ask them directly. Before working with Amity Ventures on a project this summer, I suggested a bunch of project ideas, which all ended up being pretty inapplicable. However, the firm needed help with material for their newly-virtual LP conference, so I ended up working on a video-editing project highlighting interviews with selected portfolio companies. I would have never come up with this on my own! Many times the firm knows what it needs best.

Let's get into some of the ways that students and early-career professionals can be helpful to VC firms!

Investment-side projects

Sourcing and market research are two projects that are commonly assigned by VC firms to student interns. They're probably what you'll most commonly end up doing if you're completing a VC summer internship at a place with an established intern program.

- Sourcing: this is the process of finding new companies for the VC firm to invest in. It's at the "top of the funnel" which means you cast a very wide net and scour many sources for potential investments, then use some kind of process to narrow down the options you'll look into more deeply. Everyone has their methods for sourcing (Product Hunt, LinkedIn Sales Navigator, accelerator demo days, university entrepreneurship clubs, etc). My friend Ayushi wrote a great article on sourcing you can check out on Medium.

- Market research: here, you'll pick an area of focus and do research into the current state of the industry and where it might be moving in the future. The VC firm can help you find an area to research that they'd like to know more about. I completed market research projects for Foundation Capital and Accel, focusing on B2B use cases of AI and JAMstack companies respectively. You could try splitting up your research into a qualitative part (explaining technical concepts, describing the state of the industry, etc) and a concrete / actionable part (top early-stage startups to check out, top influencers in the field to follow, future industry predictions, etc). For more details on market research, check out this Quora thread here.

Platform-related projects

As a student, you can spend time on projects for VC firms that are not directly related to investing activities. This is called "platform" and often includes marketing, event-planning, community-building, etc. It seems like there are more and more platform-oriented opportunities popping up every day (for both interns and full-time professionals).

Events

Note – while in-person events are probably optimal, it's hard to do that during the current COVID-19 era, but no worries because these events are all completely doable virtually.

- Pitch competition. This works especially well for early-stage VC firms, where you can focus your pitch comp on undergraduate / recent alumni founders. It's the type of event that is especially doable virtually. I recently planned a Boston-wide virtual pitch competition for Contrary and wrote a blog post detailing our exact planning process if you wanted to check that out as inspiration / a template for your potential virtual pitch competition.

- Summer accelerator. This is another program that works well for early-stage VC firms, especially those hoping to incubate some young promising companies. Just by creating and publicizing a summer accelerator, a VC firm can spread awareness of their brand, and then work closely with the top applicants for a few months. Most accelerators offer some combination of cash, mentorship, and events / programming. Check out this Medium post with tips on how to plan a startup accelerator, and look to existing accelerators to help shape your program.

- Speaker series & AMA events. These types of events are low-cost brand-builders for VC firms. Most firms already have an extensive network of talented professionals that would be perfect for speaker events. By hosting AMA's with these people and opening the event up to the public, a firm can reach new audiences and build their brand with minimal effort (especially for virtual speaker events). Read through Hootsuite's rundown of the different types of AMA events you could hold, and how to execute them effectively.

General

Here are some other general platform-side activities you could help with. For more ideas, check out the brief section on platform at the bottom of this article.

- Create or maintain a talent community. Lots of VC firms seem to be creating talent communities trying to keep promising builders or future VC's in their network. It's great for deal flow or potential future hires. Community-building isn't the easiest task, and this one will require a lot of effort! I may be biased but I'd say Contrary Talent is one of the pioneers in this space; check it out to get inspired.

- Create and promote content. This is a pretty broad one, and you can help out wherever your skills are best suited. This could mean writing blog posts (covering industry reports, portfolio company updates, etc), recording a podcast, or producing marketing videos highlighting portfolio companies. You can also help promote this content, both generically (Medium, Hacker News, etc) and in places specific to each piece of content (like posting an industry report on AI to developer communities).

- Help with the public newsletter. If one isn't already in place you could suggest creating one. This overlaps with the previous point on content, as newsletters often feature links to recent blog posts. You could also help curate jobs at the VC's portfolio companies in a featured job section, or compile other event recaps and relevant articles. You could also help grow the newsletter's following through various marketing strategies.

- Develop or maintain relationships with accelerators. Likely, most VC firms will already have relationships with popular accelerators; if not, you could try compiling a list of relevant ones (like B2B accelerators if that's what the VC firm focuses on) and reaching out to form relationships. You could also attend demo days and write event recaps for partners who don't have time to do that, highlighting the top startups involved and where to learn more.

- Create or run an internship program. If the VC firm doesn't hire interns, you could make a convincing argument for why they should (which could be a whole separate blog post – in short, it helps add top young talent to the firm's network or identify potential future hires). If they do, you could offer to help run the program making sure it's engaging from a student's perspective (identifying speakers young people would find exciting, incorporating the latest tools and technologies, making sure the training isn't confusing, etc). You could also create or run a scout program (check out Indie.vc's scout program).

- Create or run a fellowship program. Unlike an internship program, where students are hired to work directly for the VC firm, in a fellowship program students work for the VC's portfolio companies over the summer (in coding, product, design, or non-technical capacities) and attend some AMA / networking events hosted by the VC firm (I did the Soma fellowship, check out the programs at KP, Bessemer, True, 8VC, Floodgate, etc for inspiration).

- Help run social media accounts. This could mean coming up with original content to post on the firm's LinkedIn, Twitter, and other accounts. You could also take a more hands-off approach if the firm isn't comfortable with that, like simply replying to or liking relevant Tweets from thought leaders or founders.

Other internal projects

You can also work on projects with an internal focus; this means projects that are more related to the VC firm's operations itself. Oftentimes operations-specific activities focus on portfolio companies, legal compliance, strategy, etc (this varies widely from firm to firm).

- Analyze current and exited portfolio companies. You can use publicly-available information (from LinkedIn, Crunchbase, Pitchbook if you can get access, etc) to run quantitative analysis on the VC firm's portfolio companies (funding raised, number of articles about the company, investors, etc). You can also write up a qualitative analysis, or get more specific insights from the firm's partners who invested in each portfolio company. Check out Bessemer's Memos page.

- Help portfolio companies with projects. If you're working with a VC firm and somehow have free time on your hands, or notice a company in the portfolio in particular need of help, you could suggest working on a one-off project for a portfolio company. You could lend your skills in software engineering or design for a quick project, take some quick tasks off their plate, or doing alpha / beta testing and provide product feedback (which is especially valuable for products targeting younger audiences).

- Help plan and run events for the internal community. As opposed to external events seeking to build the brand and draw founders to the firm, internal events often focus on the VC firm's portfolio companies' founders specifically (connecting their CEOs to share knowledge, exclusive roundtables / AMA's for portfolio company employees, etc).

- Create a web scraper to help automate sourcing. Some basic software engineering skills might be required for this one. You could build web crawlers that scrape LinkedIn or other datasets, set up a database, and use an email API to send outreach emails for sourcing purposes. With your database, you could use machine learning / natural language processing on the startups' blurbs or websites to categorize them or summarize what they do quickly for other analysts to look at. Depending on your technical skills, there are lots of possible projects to work on in this category.

- Help optimize existing workflows and CRM's. Maybe there's a backlog of work that needs to be done to keep the firm's database of contacts (founders, LP's, portfolio companies, etc) up to date. Or perhaps there are inefficiencies in the way that sourcing or due diligence is being performed that no one's had the time to fix, or that you've noticed on your own and have a solution for. You could suggest helping out with that.

- Help with things on the LP side. This one's a long shot. Limited Partners are the institutions (pension funds, family offices, etc) that give money to the VC firms to invest. A VC firm may want its partners to handle this, but if you're working for an angel syndicate you could help research potential new LP's / clean up the CRM of existing ones, or create material to send to the LP's about how the portfolio companies are doing.

- Create or run the firm's (virtual) retreat. A bunch of VC firms host weekend-long retreats (and many host company bonding day trips). There may be a bunch of logistics involved here that the firm could use some help with when things get busy. This is something I have little experience with, so I won't claim to be an expert here, but there's probably more to be found on the internet.

More about Platform

There are many ways that students can be helpful to VC's beyond sourcing and market research, and the types of useful projects will vary highly from firm-to-firm. You may need to get creative and figure out a VC firm's key activities and areas for improvement.

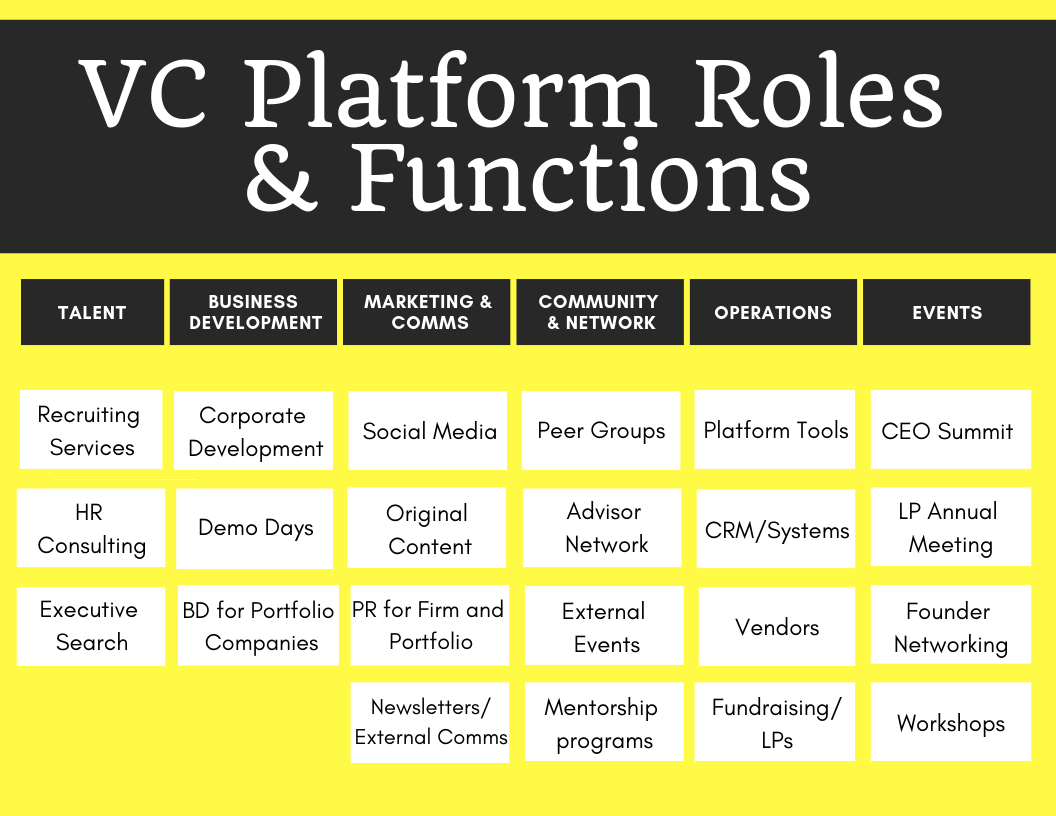

Lerer Hippeau wrote a great article called "Paths into Venture Capital: Decoding the VC Platform role" that includes a nice graphic I wanted to display below. This could serve as more inspiration for projects to work on. All credit to Lerer of course!

If you're curious about what is involved in the VC platform role, you can read Lerer Hippeau's article in full here:

Thanks for checking out these project ideas! If you have any questions or comments don't hesitate to reach out to me via my contact info below. Thanks!

Jack McClelland – LinkedIn | Twitter | Email